Searching for gold

In November 2013, 375,077.83 ounces of gold – worth about USD 480 million at the time – were deposited to a bank account in the Bahamas, according to the Panama Papers. The account at the local branch of Société Générale, a French bank, belonged to Hans-Joachim Kohlsdorf. For several decades, the virtually unknown 57-year-old German held various senior positions at Siemens, mainly in Latin America.

The fortune worth 480 Million USD is one of the biggest mysteries to be found in the Panama Papers. If the amount is correct, how would someone like Kohlsdorf have access to so much money? Why was this apparent transaction made? And could it have had anything to do with the Siemens slush funds that made for the largest bribery scandal ever seen in German business? The scandal cost a number of executives their jobs – including members of the Siemens board of management and supervisory board – and it kept state prosecutors busy for years. For decades, hundreds of Siemens executives had operated a global network of secret accounts and companies. They used these to bribe civil servants, politicians, or business partners. Over time, billions of euros in bribes were paid.

Using offshore companies is the best way to cover up bribes

Kohlsdorf, the man with the account in the Bahamas, was one of the people under investigation. During a hearing at the Munich state prosecutor’s office, he admitted to having managed slush funds for several national Siemens subsidiaries in Latin America. However, he got off lightly because it couldn’t be proven that he paid bribes himself. Moreover, as a result of having cooperated with the authorities, the Munich state prosecutor ended the investigation against Kohlsdorf in 2012 due to insignificance. In the end, he was only required to pay a fine of EUR 40,000.At the time, prosecutors were sympathetic to Kohlsdorf’s plight, stating that his actions had been purely the result of a “misunderstanding of corporate interests”, and that he had enabled the "full return" of the remaining slush fund millions.

At any event, Kohlsdorf got off with a clean bill. But was this justified? Did Kohlsdorf really return all of the money? The Panama Papers suggest that Kohlsdorf didn’t, that he may in fact have helped himself to some of the slush fund money, and that he may not have returned the full amount of remaining funds to Siemens.

In several ways, the documents leaked from the Mossack Fonseca law firm shed new light on the Siemens scandal. They provide insights that investigators in Munich did not have at the time of the investigations. For instance, it now seems that Mossack Fonseca was an important partner for Siemens, and managed a number of shell companies for the German corporation. After all, using offshore companies is the best way to cover up bribes.

Harry Potter, Señor K. and Bruni

For a long time, Kohlsdorf was one of the most important Siemens executives in the region. He directed business in the Andes region from 1997 onward, and in Mexico from 2003 to 2009. According to his statements at the state prosecutor’s office, Kohlsdorf had access to slush funds worth more than USD 100 million, most of which was paid back to Siemens from 2008 onward. A portion of this money was ostensibly used to reward business partners and civil servants for getting Siemens contracts.At Mossfon, Kohlsdorf and other Siemens executives were considered special clients, as people “with a great deal of money”, as an internal Mossack Fonseca memo states. Their business dealings were to be treated with “utmost confidentiality”. The law firm informed its employees never to send any documents to Kohlsdorf, insisting that everything had to stay in Panama. Mossfon’s services included everything necessary to protect the law firm and Siemens customers. For instance, in the documents, Kohlsdorf’s name was almost always abbreviated; he was referred to as "Señor K." Even email accounts with code names such as "Azkaban" – the prison for wizards in the world of Harry Potter – were created. And yet, in some cases, the managers of the shell companies and their clients were careless. Another email account bore the name “Bruni”, the name of Kohlsdorf’s mother.

Despite such lapses, the system of secrecy worked, even when the Siemens bribery scandal was exposed in November 2006 and investigators, lawyers, and auditors closely examined the company’s activities. In general, investigators saw only the German portion of the affair: how Siemens used fake invoices and bogus consultancy contracts for years to take money off the official books and move it into slush funds for bribery purposes. A number of shell companies in places like Liechtenstein and the Caribbean are mentioned in the Munich investigation files. In some instances, the state prosecutors even managed to identify people who received bribes in Russia or Nigeria.

Mossack Fonseca remained hidden from the investigators

However, Mossack Fonseca remained hidden from the investigators, who were unaware of what the law firm did for Siemens. The Munich state prosecutor’s office sent a letter rogatory to Panama. The main questions were left unanswered. Investigators then concluded that sending a second letter rogatory wouldn’t make sense.As a consequence, Siemens’ links to Mossfon – and with them Kohldorf’s links –remained in the dark for nine years, until now. On June 10, 2008, Kohlsdorf testified for three hours at the state prosecutor’s office, and investigators were still unaware of the link to Mossfon afterwards. As the documents reveal, on the very same day as his testimony, Kohlsdorf’s contact person at Mossack Fonseca sent an email to an internal distribution list stating that he had just received “bad news”. It was possible that the Siemens millions would have to be transferred back to Germany. This meant that “we will lose this money and our client Gillard”.

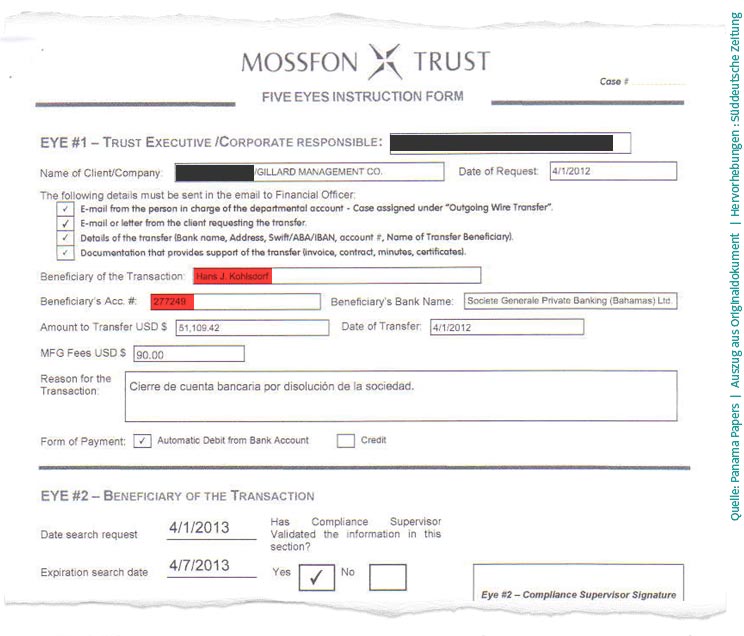

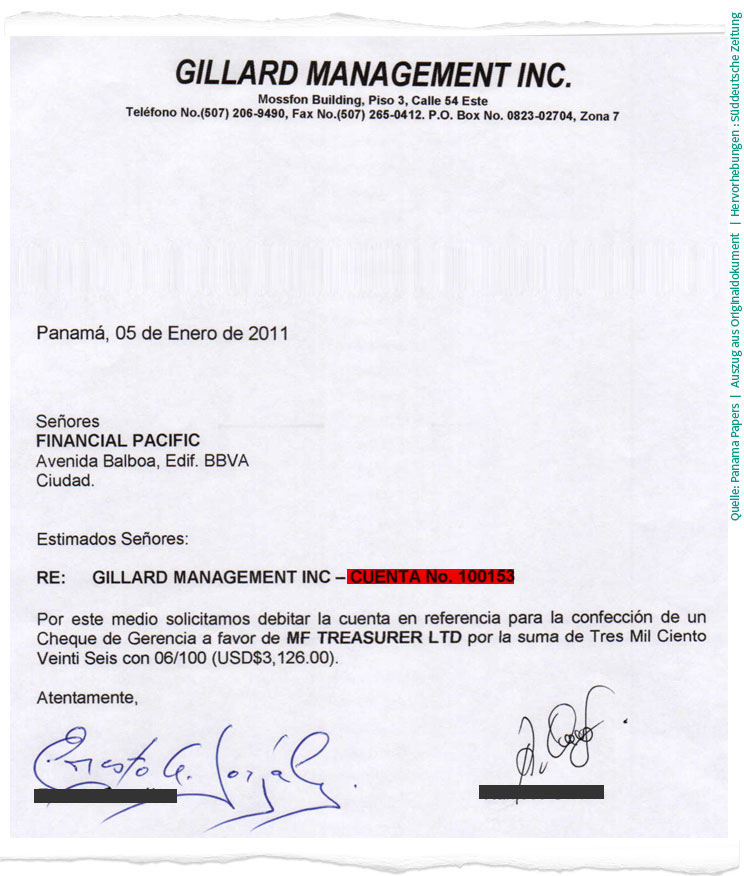

Gillard Management was a shell company with accounts in Panama, Singapore, and Switzerland. As the email exchange and leaked documents show, Kohlsdorf and other Siemens employees were involved with the administration of this company. Oddly, Gillard wasn’t founded until 2007, several months after the Siemens scandal was exposed in November 2006. Thereafter, millions of dollars were moved through Gillard accounts, but the detailed reasons behind these transactions remain unclear. Mossack Fonseca did not reply to SZ’s request for comment on the matter. Kohlsdorf, in turn, has denied knowing anything about a company called Gillard Management. And yet in internal emails, a Mossfon employee names him as the initiator of the company’s foundation.

This isn’t the only mystery. Even more puzzling are the 480 million dollars in gold that the Panama Papers suggest were deposited in the fall of 2013 on Kohldorf’s Société Générale account in the Bahamas. The transaction is listed in an account overview that Mossack Fonseca kept as a record of the banking activities it managed for its clients. It shows thousands of money transfers, some of them in dollars, others in euros, and others in gold. Mossfon employees neatly listed whom the money went to. While only a few thousand dollars were transferred in some instances, in others a few million were moved from one offshore account to other. In one case, even tens of millions of dollars were transferred. A single transfer worth 480 million euros would be rather unusual.

If payments from the account overview are compared with documents from the Panama Papers and other sources, there is much to suggest that these payments were made. What’s more, Kohldorf’s name appears on some of these payments, which were made through the account at Société Générale in the Bahamas. Kohlsdorf confirmed to SZ that the account belonged to him.

But what about the 480 million euros in gold? Were they also deposited on his account? And did the money belong to him? Kohlsdorf has denied that such a large amount of money was ever deposited to his account. Société Générale has stated that it cannot confirm having recorded a payment of that size in its books.

A sign of market manipulation

It could just be a bizarre coincidence that gold trading was temporarily suspended at the London Stock Exchange on the very same day that the gold is thought to have appeared on Kohlsdorf’s account. Within ten seconds, the price of gold dropped by 10 US dollars, which is a sign of market manipulation. The movement of half a billion dollars worth of gold on the market could certainly spark such developments. Whether or not the transaction could be linked to these developments is unclear; the London Stock Exchange has not disclosed any details. Bafin, the German financial supervisory authority, which at the time had also initiated an investigation against Société Générale, has also remained silent on the matter.Beyond the information contained in the Panama Papers, there is no trace of the 480 million dollars in gold anywhere, and thus nothing to prove that it actually existed. But what if it did? Did Kohlsdorf simply borrow a few hundred million dollars from somewhere for speculative reasons? Did he try to transfer the sum to his account, which was rejected by Société Générale? Could this be why the bank “did not record” the transaction, as it has claimed? There are a number of possibilities here. However, one thing is clear: the account in the Bahamas also appears elsewhere in the Panama Papers. For instance, a shell company called Gillard, which Kohlsdorf claims he has never heard of, once transferred money to this account.

Kohlsdorf even provided the state prosecutor’s office with documents that referred to a Gillard account at a bank in Panama, for which he was named as the beneficiary. However, the company name does not appear in the Panama Papers. According to documents that Kohlsdorf turned over to investigators, there were USD 4,189,696.17 on the account on June 30, 2008. During the hearing, Kohlsdorf mentioned a sum of six million. At any event, the money on the account belonged to Siemens. And yet only USD 4.1 million were transferred back to the company. A bank statement found in the Panama Papers shows that, on June 30, 2008, there were actually USD 6,141,461.79 on the account, two million dollars more than the amount mentioned in the state prosecutor’s files.

These extra two million dollars stayed on the account as repayment to Siemens progressed, and the money was still there afterwards. As Mossack Fonseca documents show, Kohlsdorf used this money to have bonds acquired for him and to make other investments. Later on, he appears to have deposited the money to a new Gillard Management account at Andbanc, a bank in Andorra.

To make things even more complex: in the summer of 2012, when the investigation against Kohlsdorf was closed, two million dollars on an Andorra account moved to UBS in Zurich. According to the transfer slip, the account belonged to a bank employee. At the time, Kohlsdorf had no longer been working for Siemens for three years.

The transfer to Zurich apparently almost failed, as a compliance department employee at Mossfon googled the banker’s name and found anonymous hints that he had been involved in money laundering. Perhaps more importantly, Mossfon didn’t have a copy of his passport. However, Kohldorf’s client advisor at Mossfon, a German, dismissed any concerns. But the question remains as to why the UBS banker received the money. While he declined to respond to a request for comment on the matter, he did state that he never personally benefited from Siemens money. UBS has also declined to comment. An internal UBS source who is aware of all the details – including the date, the sum, and Gillard Management – has named someone else as account holder: not a banker, but Hans-Joachim Kohlsdorf himself.

If this were true, it would mean that the former Siemens executive moved the rest of the slush fund to a Swiss bank account after the investigation against him was closed. At a hearing at the Munich state prosecutor’s office a few years earlier, Kohlsdorf had stated that he “never took money from the accounts for personal use”. For the state prosecutors, this statement was one of the decisive reasons why the case against Kohlsdorf was closed. Kohlsdorf did not answer the SZ’s request for comment as to whether the UBS account belonged to him.

According to the Panama Papers, the remaining money in the Andorra account was also distributed. Mossack Fonseca received EUR 80,000 as commission, and Kohlsdorf had another USD 20,000 transferred to a former Siemens colleague in Ecuador. Another USD 50,000 remained. According to Mossack Fonseca, the bank had already been told that the money would be paid to a friend. This “friend” was Kohlsdorf himself. As the Panama Papers show, in the spring of 2013 the USD 50,000 ended up in exactly the same place as the apparent 480 million dollar six months later: at Société Générale in the Bahamas.

Siemens has stated that the company knew nothing about the establishment of Gillard Management and the movements of money. These procedures were carried out "beyond Siemens’ sphere of knowledge and influence”.

An old pal’s urgent need for cash

But the story goes even further. Another ex-Siemens man also appears to have helped himself to funds at Casa Grande Development, a company that Mossfon also managed. The Munich state prosecutor’s files mention it as a shell company for slush funds. He wrote to his Mossfon client advisor that he was in “urgent need of cash”. His “old pal” had left him sitting on a “financial deficit” of more than half a million dollars. From 2009 onward, the former Siemens employee gradually had USD 630,000 transferred from the company to himself. The Panama Papers reveal that the money was declared as “property tax” in some instances, and as “consulting fees” in others. According to the Munich investigation files, in 2008 he stated that he would not lay further claim to the money still on the accounts of Siemens AG. However, he appears to have cashed in. He did not respond to requests for comment.According to the Panama Papers, USD 32 million were returned to Siemens from slush funds in South America. Until now, the company appears to believe it received the full remaining amount. In June 2010, Peter Solmssen, at the time general counsel at Siemens, issued a confirmation stating that all the funds Kohlsdorf had managed and mentioned had been returned to the company. Both Siemens and investigators believed that they were dealing with a repentant sinner. Kohlsdorf had paid his EUR 40,000 monetary fine on time, including EUR 10,000 to the Bayerischer Landesverband für Gefangenfürsorge, a Bavarian organization that supports ex-convicts. After these payments were made, the state prosecutor noted in August 2012 that prosecuting Kohlsdorf was “no longer in the public interest.”

In a bid to explain how all of this happened, Kohlsdorf stated that his email account was hacked at the beginning of 2014, and that all of the documents must thus be fake. At the same time, he contradicted this statement by confirming individual transfers and the existence of the account in the Bahamas. As for the 480 million dollars in gold, Kohlsdorf stated that he had “never seen such an absurd situation” in his entire life. At the end of February, he confirmed that he would get the bank statements from Société Générale to solve this mystery.

Since then, however, Kohlsdorf has not responded to any more requests for comment.

Contributors: Hans Leyendecker, Klaus Ott